7 Easy Facts About Insurance Account Shown

Wiki Article

Some Known Incorrect Statements About Insurance Agent

Table of ContentsFacts About Insurance Code UncoveredExamine This Report about Insurance MeaningIndicators on Insurance Code You Should KnowSome Known Factual Statements About Insurance Asia Awards Not known Factual Statements About Insurance Agent

Other kinds of life insurance policyGroup life insurance coverage is commonly supplied by employers as part of the business's work environment benefits. Premiums are based on the group as an entire, instead than each person. Generally, employers provide basic protection for complimentary, with the alternative to acquire additional life insurance coverage if you require more coverage.Mortgage life insurance coverage covers the current equilibrium of your home mortgage as well as pays to the lending institution, not your family members, if you pass away. Second-to-die: Pays out after both insurance policy holders die. These policies can be used to cover inheritance tax or the treatment of a dependent after both policyholders die. Often asked concerns, What's the most effective sort of life insurance policy to obtain? The very best life insurance coverage policy for you boils down to your needs and budget. Which sorts of life insurance policy offer adaptable costs? With term life

insurance policy and also whole life insurance policy, premiums commonly are fixed, which suggests you'll pay the very same amount every month. The insurance policy you require at every age varies. Tim Macpherson/Getty Images You require to purchase insurance to shield on your own, your household, and also your riches. Insurance can save you thousands of bucks in the occasion of an accident, ailment, or catastrophe. Health insurance policy as well as auto insurance are called for, while life insurance policy, property owners, occupants, and handicap insurance coverage are urged. Begin absolutely free Insurance policy isn't one of the most awesome to consider, but it's requiredfor safeguarding on your own, your family members, and also your wide range. Accidents, health problem, as well as calamities occur at all times. At worst, occasions like these can plunge you into deep economic destroy if you do not have insurance policy to fall back on. And also, as your life adjustments(state, you get a new job or have a baby)so must your coverage.

What Does Insurance Quotes Do?

Below, we have actually clarified briefly which insurance coverage you should highly consider purchasing every stage of life. Keep in mind that while the policies listed below are organized by age, of course they aren't prepared in stone. Lots of individuals most likely have temporary disability via their company, long-lasting handicap insurance coverage is the onethat the majority of people need as well as do not have. When you are damaged or unwell and not able to function, disability insurance coverage gives you with a percentage of your income. As soon as you leave the working globe around age 65, which is often the end of the lengthiest plan you can buy. The longer you wait to purchase a plan, the better the eventual expense.If somebody else counts on your income for their financial well-being, then you most likely need life insurance policy. Even if you do not have dependents, there are various other reasons to live insurance policy: private student finance financial debt, self-employment , or a family-owned company. That's less than the cost of a gym membership to protect your household's economic security in your lack. The very best life insurance policy policy for you relies on your spending plan along with your economic objectives. There are 2 primary sorts of life insurance policy plans to pick from: permanent life and term life. When your dependents are no more depending on you for financial backing. Insurance policy you require in your 30s , Home owners insurance coverage, House owners insurance coverage is not needed by state law. Nonetheless, if you have a home loan, your loan provider will call for house owners insurance coverage to protect the visit the site investment.Homeowners insurance safeguards the home, your possessions, and also offers responsibility protection for injuries that happen on your residential property.If you offer your home as well as go back to leasing, or make various other living plans. Pet insurance policy Animal insurance policy may not be taken into consideration a must-have, unless. insurance asia awards.

About Insurance Quotes

you intend to fork over $8,000 for your pet dog's surgical procedure. Some strategies also cover routine veterinarian visits and vaccinations, and also the majority of will certainly repay as much as 90%of your vet costs. This is where lasting care insurance or a crossbreed plan enters play. For people who are aging or impaired as well as need aid with everyday living, whether in a nursing home or via hospice, long-lasting care insurance policy can assist take on the inflated costs. Long-term treatment is expensive. Nonetheless, many Americans will require long-term treatment at some factor during their retired life. You are going to Spain for the very first time. insurance asia awards. You have a stop-over at Abu Dhabi. Your very first flight obtains postponed. You miss the 2nd flight and also get stuck. You are driving to work like every various other day. But the roadway has oil spill.

The Ultimate Guide To Insurance Account

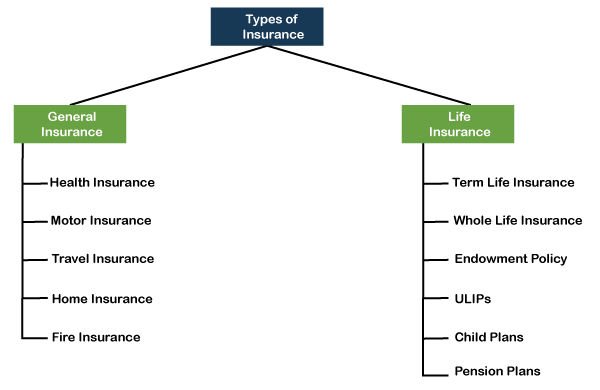

-If, however, you make it through the term, no cash will be paid to you or your household. -Your family gets a particular sum of money after your death.-They will also be entitled to a bonus that commonly accumulates on such quantity. Endowment Policy -Like a term policy, it is likewise legitimate for a certain period.- A lump-sum quantity will certainly be paid to your family in the event of your fatality. Money-back Plan- A certain percentage of the sum guaranteed will certainly be paid to you occasionally throughout the term as survival advantage.-After the expiry of the term, you obtain the equilibrium quantity as maturation earnings. -Your family gets the entire sum guaranteed in case of linked here death during the policy period. The amount you pay as costs can be deducted from your total taxable income. However, this is subject to a maximum Find Out More of Rs 1. 5 lakh, under Section 80C of the Income Tax Act. The premium amount used for tax deduction ought to not surpass 10 %of the sum assured.What is General Insurance? A basic insurance policy is a contract that supplies monetary payment on any loss various other than death. You could, hence, go ahead and also shock your partner with a ruby ring without stressing over the treatment expenses. The dent in your auto didn't create a dent in your pocket. Your electric motor insurance policy' own damages cover spent for your cars and truck's damages triggered by the accident.

The 15-Second Trick For Insurance Commission

Your health and wellness insurance policy took treatment of your therapy expenses. As you can see, General Insurance policy can be the answer to life's different problems. Pre-existing diseases cover: Your wellness insurance policy takes treatment of the treatment of conditions you might have prior to purchasing the health and wellness insurance plan.Two-wheeler Insurance, This is your bike's guardian angel. As with vehicle insurance policy, what the insurer will certainly pay depends on the kind of insurance coverage as well as what it covers. Third Party Insurance Policy Comprehensive Auto Insurance Coverage, Makes up for the damages caused created another individualPerson their vehicle lorry a third-party propertyResidential or commercial property

Report this wiki page